August’s ETF Liquidations Signal Epic Gains Ahead – August 15, 2024

It isn’t often that investors rush for the exits all at once.

But when they do, grab stocks with both hands.

August’s ETF liquidations signal epic gains ahead.

Investors often look for catalysts before buying stocks. Maybe it’s a positive earnings call or some hot new gadget with explosive growth potential.

On the macro side it can be watching jobs numbers or inflation data.

Get on the right side of an inflection point and you stand to make big gains on your investment.

But what rarely gets discussed in the financial media are the powerful inflection signals that arrive in the rare moments when investors dump assets in droves.

These capitulation periods, while extremely rare, offer some of the strongest near-term bullish catalysts for equities that you’ll find.

August 5th’s market plunge saw an immense number of ETFs sold…the most since October of last year. Looking back, these forced selling events preface huge market-beating gains ahead.

Today we’ll dive into this rare datapoint and which areas we are focused on into yearend.

August’s ETF Liquidations Signal Epic Gains Ahead

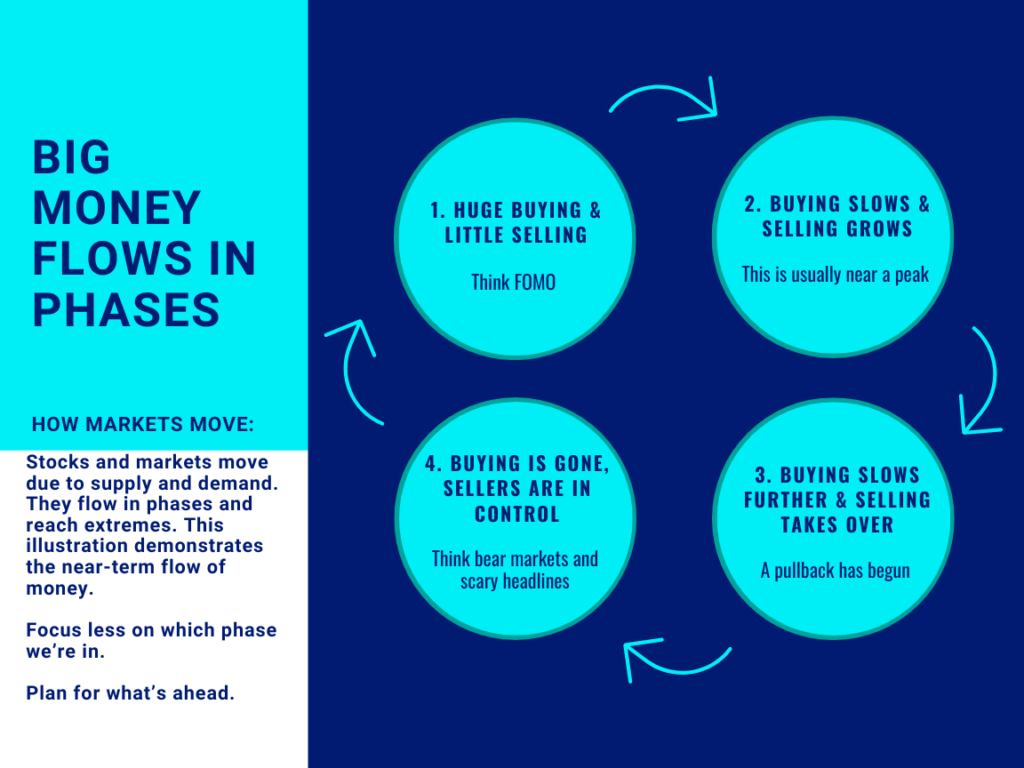

It’s important to understand the continuous phases of money flows. The 4 phases work in a circular rotation described as:

Phase 1: Huge buying and nearly zero selling (think FOMO)

Phase 2: Buying slows as selling increases (market peaks form here)

Phase 3: Buying slows further as selling takes over (pullback is underway)

Phase 4: Forced selling occurs, no buyers to be found (scary headlines)

Here’s an illustration highlighting the Big Money phases:

Last Monday’s market crash had all of the elements of phase 4, where buyers retreated and forced selling was seen in both equities and ETFs.

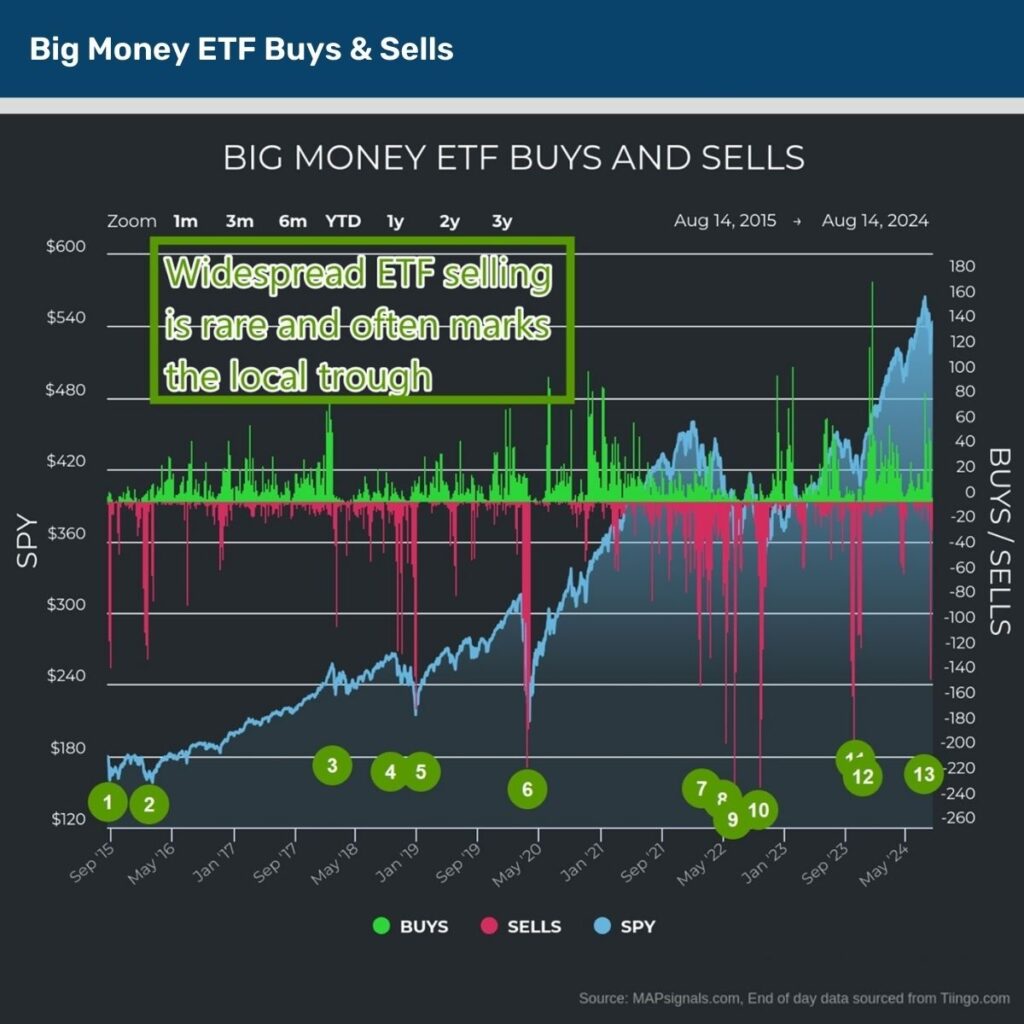

On August 5th, widespread ETF liquidations were seen with an immense 142 funds sold. To put that into perspective, it’s the single largest daily count since October of last year.

You guys should remember how bullish we were back then. We were one of the few research shops to make the case that a massive rally was coming soon.

When you simply look at these rare capitulation events overlaid on the S&P 500 (SPY ETF), you can understand why we were banging the bullish gong.

Below reveals the daily count of ETFs bought and sold in our data. I’ve singled out days when at least 125 funds were sold, echoing the action seen last Monday:

It should jump out that these large red waves of sell pressure often lineup with local market troughs. And they do.

When everyone is rushing for the exit all at once, prices become stretched to the downside, reaching unsustainable panic levels.

This is where awe-inspiring inflection points occur.

Ask any major hedge fund which money flow signal they care about most and odds are it’ll be forced selling events.

That’s the greenlight.

But don’t take my word for it. Let’s run the numbers.

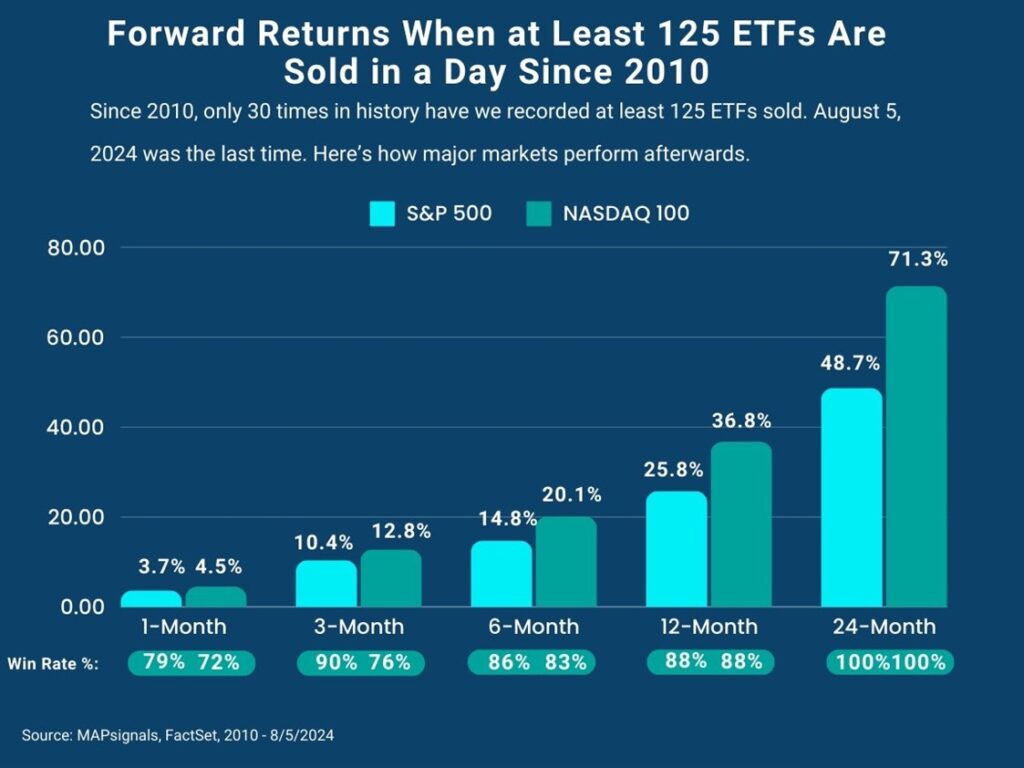

Back to 2010, I grouped all instances when at least 125 ETFs were sold. It’s only happened 30 times in history.

It’s one of the most powerful bullish signals you’ll find with:

- Average 3-month gains of 10.4% for the S&P 500 and 12.8% gains for the NASDAQ 100

- Average 12-month gains of 25.8% for the S&P and 36.8% gains for the NASDAQ

- 24-month gains of 48.7% for the S&P and 71.3% for the tech-heavy NASDAQ

After being in business for 10 years, we’ve learned firsthand how lucrative forced selling events are. That’s why we were telling our members to buy semiconductors, software, and high-growth healthcare names during Monday’s crash.

Those have been the Big Money magnets the past year. We’ll keep leaning into those megatrends. And you should too.

Couple this hard-hitting evidence with the fact that a VIX close above 38.5 is extremely constructive for stocks, and these ETF liquidations signal epic gains ahead.

This is why cutting-edge research cuts through the noise, offering insights not found anywhere else.

There are plenty of powerful stocks taking off right now as fresh money pours into markets after the latest dump.

You just need a map to find them!

Here’s the bottom line: When investors dump ETFs, take the other side. Forced selling events rarely come along. When they do, lock in on the highest quality stocks with powerful earnings growth.

After 125 or more ETFs are sold, the S&P 500 and NASDAQ 100 stage 12-month breathtaking rallies of 25.8% and 36.8% respectively.

Lasering in on prior Big Money favorite stocks is your recipe to outperform.

This is why hedge funds and other large money managers focus on capitulation events…it triggers some of the most powerful inflection signals you’ll ever find.

Now it’s up to you to take advantage of this recent rare event.

Don’t wait for the media to signal the greenlight. You’ll miss the move.

Author: Lucas Downey