Rate Cuts Are Imminent, Buy Small & Mid-Cap Stocks Now – September 12, 2024

The time has finally come.

A new macro chapter is unfolding.

Rate cuts are imminent, buy small- and mid-cap stocks now.

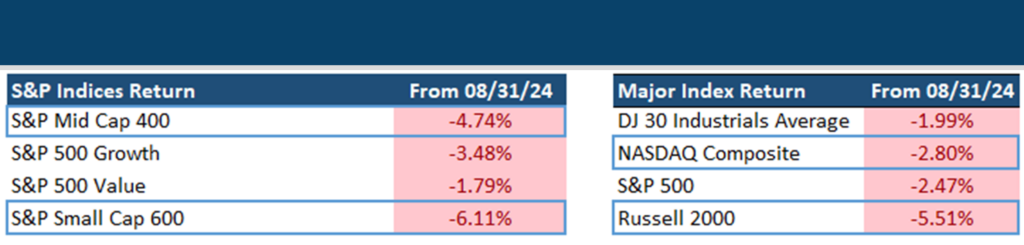

The September doldrums came right on time with all market-cap flavors taking a beating. As I write this, the S&P 500 dropped 2.5% in September and the S&P Mid Cap 400 has dropped 4.7%.

Those pale in comparison to the S&P Small Cap 600’s -6.1% drubbing.

But volatility is normal in the 9th month of the calendar. So, let’s take the dip in stride and focus on what’s ahead…better days.

And given we are on the cusp of interest rate cuts; I’m going to keep with our long-standing theme to buy small- and mid-cap stocks.

Being early to suggest smaller equities are primed for all-time highs just means the opportunity is still present. Plenty of capital is flowing there recently…and rightly so, given that the Fed is entering a new frontier of easing policy.

Today, we’ll zero in on the huge small- and mid-cap opportunity that’s ahead. It’s only a matter of time before new highs are made.

Now let’s first size up the recent small- and mid-cap landscape.

Rate Cuts Are Imminent, Buy Small & Mid-Cap Stocks Now

Last week we noted the monumental money shift towards dividend growth areas of the market. We unpacked the massive sector divergence since the June CPI etched in stone the coming rate cuts.

That rotation is one of many that’s been set in motion the last few months. As rates have cooled in the last 2 months, small- and mid-caps are easily outperforming.

This reshuffle out of large-cap and growth areas is partly due to the higher earnings power that small- and mid-caps are projected to return.

Always remember, Wall Street focuses 12-18 months from now. If an area is poised to undergo earnings expansion, share prices lift.

That’s exactly why SMID caps have outperformed lately.

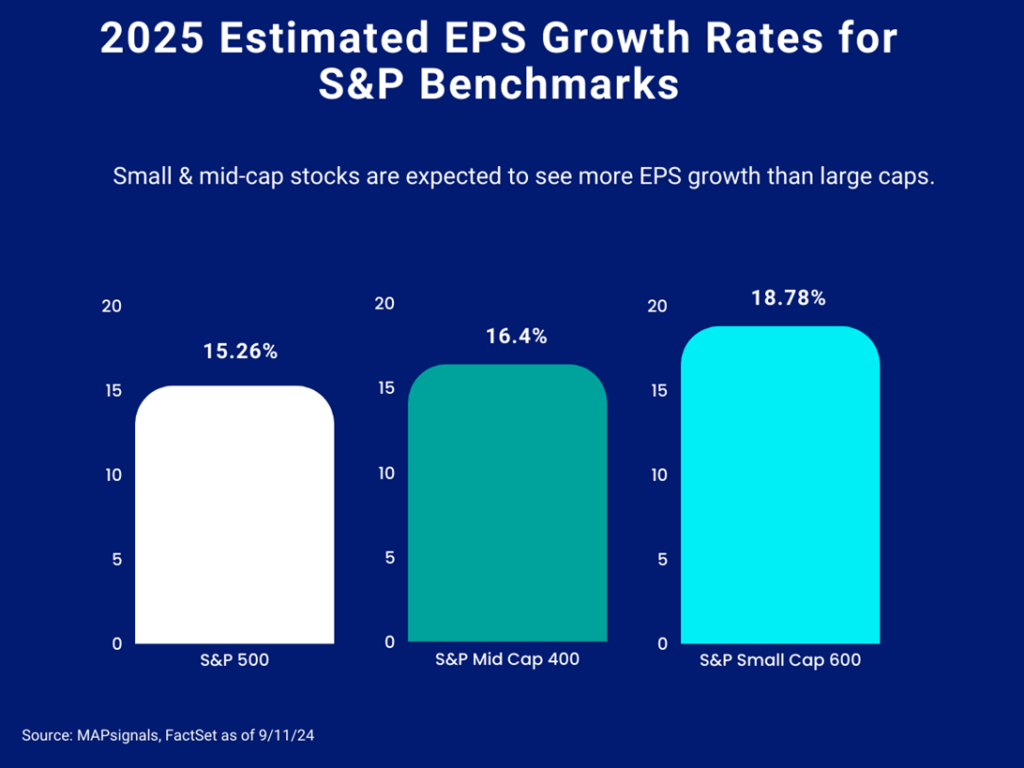

Below shows how the S&P 500 is estimated to grow EPS 15.26% in FY 2025. Not bad.

When you contrast that to a healthier16.4% EPS growth for mid-caps and 18.8% EPS growth for the SC 600, the case to increase your SMID weighting isn’t a huge leap of faith that many recessionistas would have you believe:

Now why would smaller and mid-level equities find an earnings boost next year?

Much of it comes down to their more economically sensitive nature. Smaller enterprises typically carry more debt and the costs to service those debts are higher than huge companies with pristine balance sheets.

To show you why lower interest rates matter, let’s circle back to a month ago when my colleague, Alec Young, made the data-driven case to start buying small and mid-sized stocks.

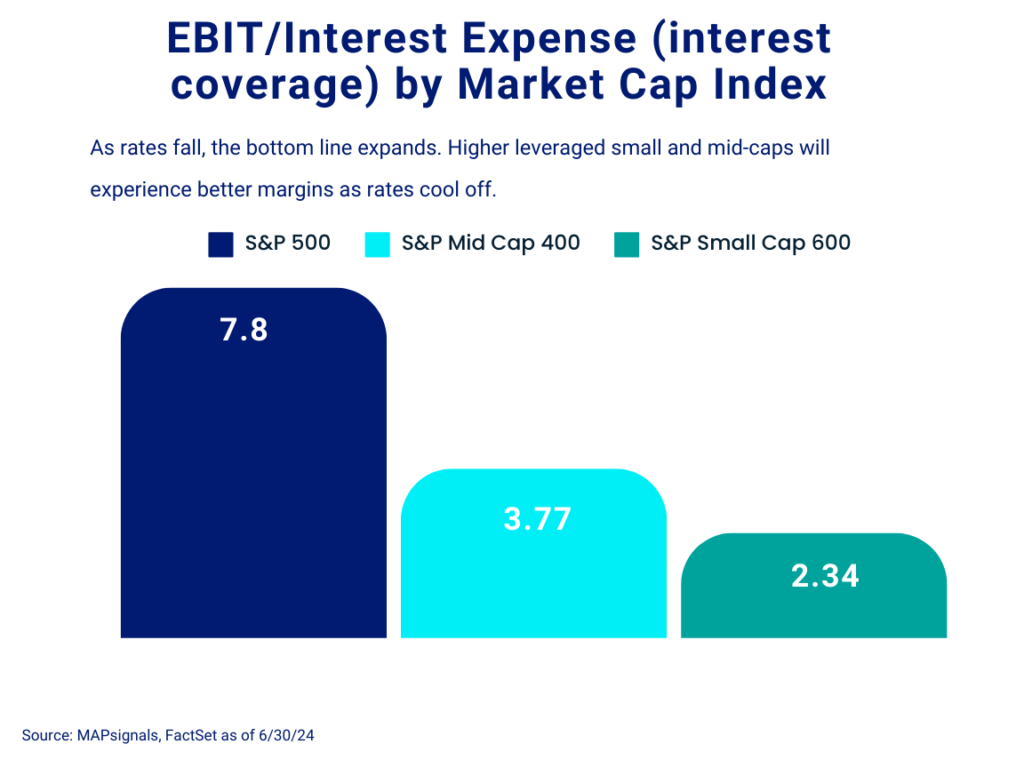

In that piece, he noted how lower rates benefit SMID stocks more because small- and mid-cap earnings have a coverage ratio much lower than the mighty S&P 500.

Consider this, the S&P Small Cap 600 has an interest coverage ratio of just 2.34 and the S&P Mid Cap 400 is a bit better with 3.77X.

These are much lower than the S&P 500’s 7.8X interest coverage ratio:

This right here is where the rubber meets the road. As interest rates get cut, bottom line earnings expansion will have a much larger impact on higher leveraged areas.

This is why we are seeing huge risk-on action in Real Estate and Communication Services areas on the lower-cap spectrum…they each have super low interest coverage ratios.

Lower rates breathe new life into these debt laden areas.

Wall Street is betting on a massive earnings growth story in SMID stocks…and you should too!

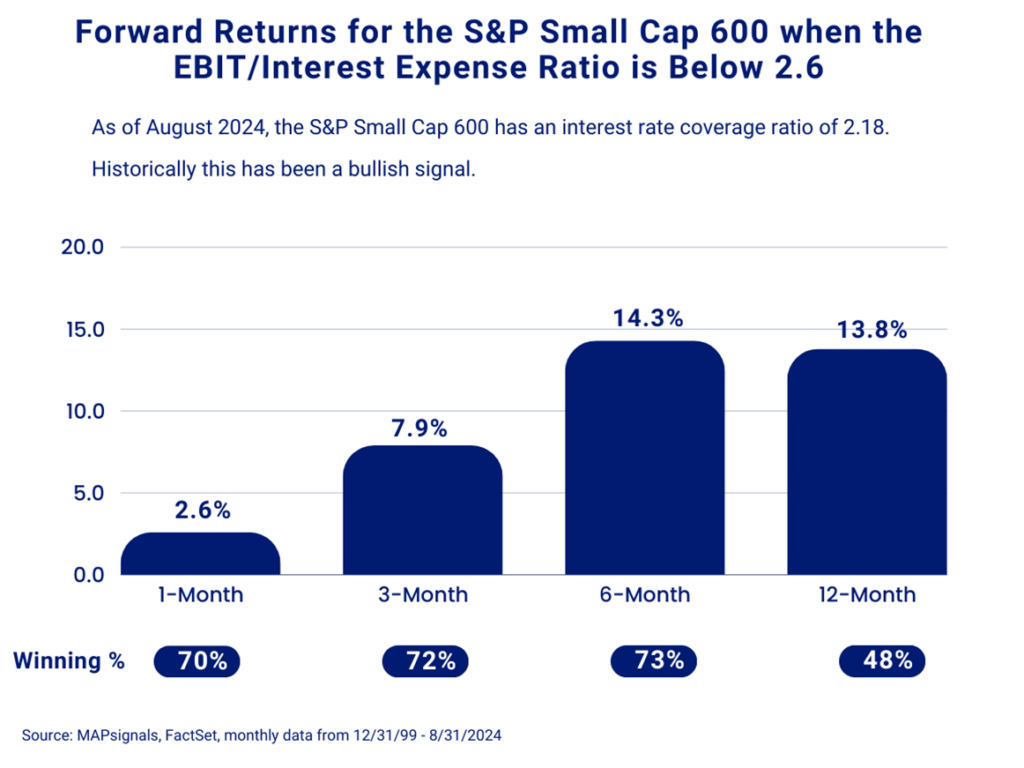

Here’s what history can teach us about moments in time when small- and mid-caps have a relatively low interest coverage ratio.

Since December of 1999, using monthly close data, the S&P Small Cap 600 has had 27 instances where the interest coverage ratio clocked in at 2.6 or lower.

Here’s the forward performance:

- A month later the SC 600 jumped 2.6%

- 6-months later small caps ripped 14.3%

- 12-months later saw the group notch a market beating performance of 13.8%

And before you notice the low winning %, realize that a lot of red came during 2022 when these lower market-capitalized areas were torched as inflation surged.

The opposite situation is unfolding today… high inflation is in the rear-view mirror.

And the good news doesn’t stop here. We find a similar narrative in mid-caps.

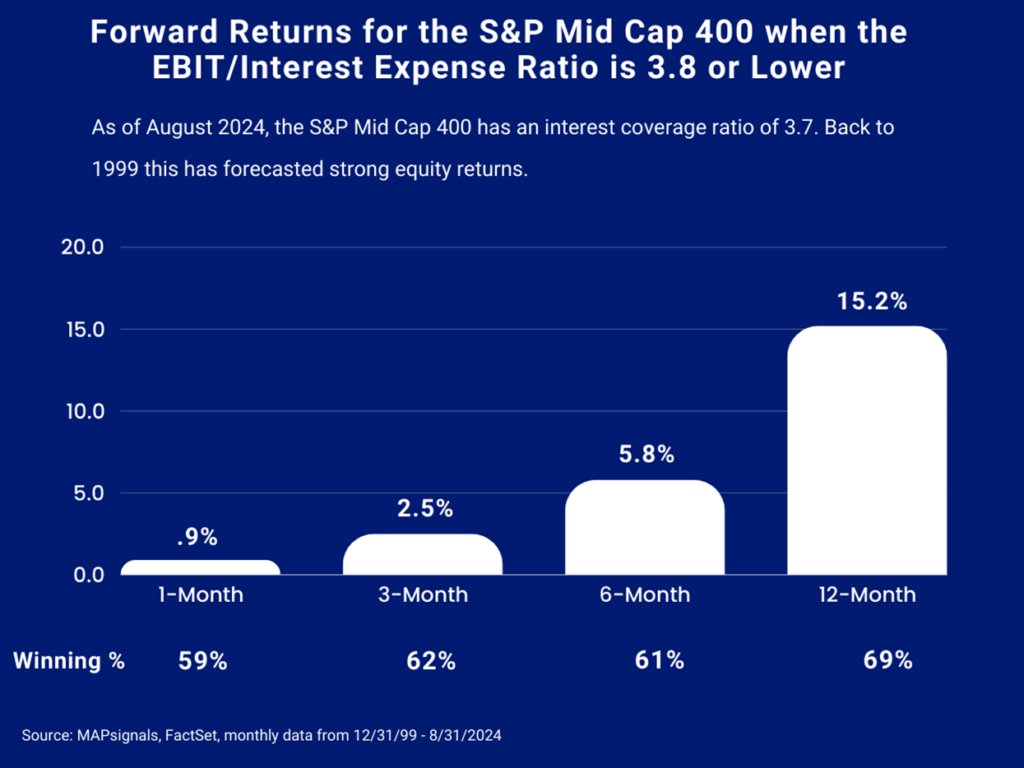

Since December of 1999, the S&P Mid Cap 400 has seen 65 instances where the interest coverage ratio notched a 3.8 or lower reading.

Below shows why better days lie ahead for this group.

Whenever the interest rate coverage for the S&P Mid Cap 400 falls to 3.8 or lower:

- 6-months later mid-caps jump 5.8%

- 12-months later they rip 15.2%

I’d say you can’t afford not to pick up smaller stocks. Rate cuts are imminent, buy small- and mid-cap stocks now!

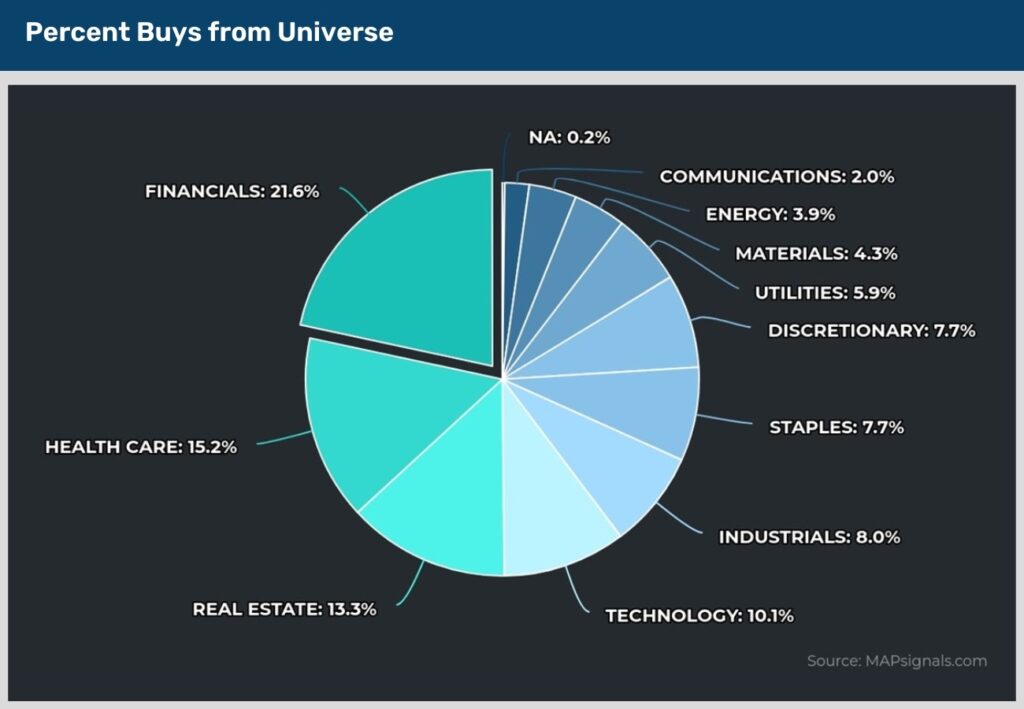

And that’s been the theme in our data since July 10th. Below reveals how 21.6% of buys are in Financials, 15.2% are in Health Care, 13.3% are in Real Estate:

The rebirth is here. Institutions are betting on the impact that lower rates will have.

Shouldn’t you?

Don’t get bounced out of stocks due to a little September volatility.

Use the red to pick up all-star stocks on sale.

The macro backdrop for small- and mid-caps is about to improve mightily.

Are you ready?

Here’s the bottom line: Rate cuts are finally here. This is going to tee up a mega risk-on environment for higher levered small- and mid-caps.

The rotation that began just 2 months ago, favors areas like Real Estate, Financials and other dividend pockets of the market…this even includes high-quality tech and health care names.

Not only that, when interest coverage ratios are as low as they are now, the S&P Small Cap 600 and S&P Mid Cap 400 boasts double-digit gains 12-months later.

Don’t try and sit this one out.

You’ll miss a wonderful buy the dip opportunity.

Go big by going smaller in your portfolio!

Lastly, join me at the Wealth365 2024 Election Summit, October 14th-19th, as I present: How to Spot Monster Small & Mid-Cap Opportunities this Election Season.

You won’t want to miss it.

Author: Lucas Downey