Trillion-Dollar Money Market Bubble is Set to Unwind – September 26, 2024

For years now, a popular mantra has been cash is king.

Wealthy households poured into money markets at a breakneck pace.

We are now witnessing the unfolding. The trillion-dollar money market bubble is set to unwind.

Ring ring.

Hello?

Hi Mrs. Debbie, Mike here with XYZ Financial, it’s time to discuss where to park your cash NOW.

That’s the conversation I envision many financial advisors (FAs) were having back in 2022 as yields surged.

As interest rates climbed, the allure of high-yielding cash not only made sense, but also good fortune. Earning a risk-free 5%+ return has been a boon!

But as they say, all good things must end…ushering in waves of change.

As interest rates are now finally on the decline, well-to-do investors face a looming dilemma…where to redirect this cash hoard that’s losing its luster day by day.

Today, I’ll reveal startling stats on the growth of money market assets. We’ll cover which areas suffered during this monster crowd-chase, and ultimately make the case for the beneficiary of the latest trillion-dollar migration that’s coming.

…and there’s evidence this money wheel is already in motion.

Trillion-Dollar Money Market Bubble is Set to Unwind

Econ 101 taught us the power of supply and demand.

When income-starved investors are greeted with a new-found cash stream, they pounce.

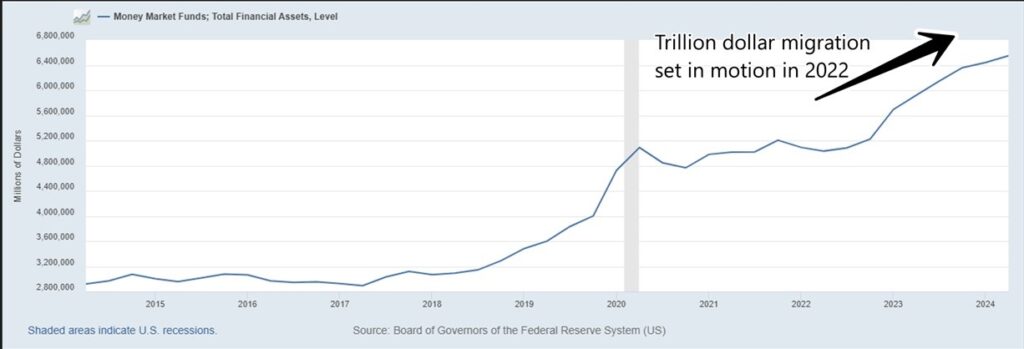

You can see how from Q1 2022 to Q2 2024, total money market assets climbed from $5.1 trillion to $6.5 trillion:

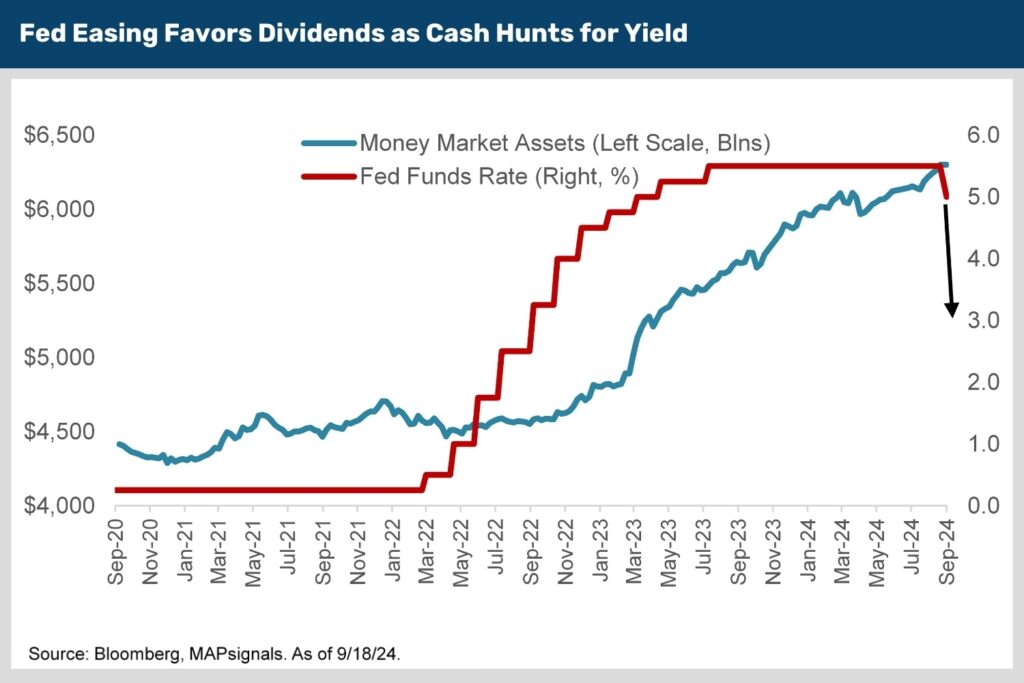

When we zoom in, we can clearly understand how the rise in rates correlated with the increase in money market asset demand.

The call from FAs to start the money migration back in 2022 was met in full force:

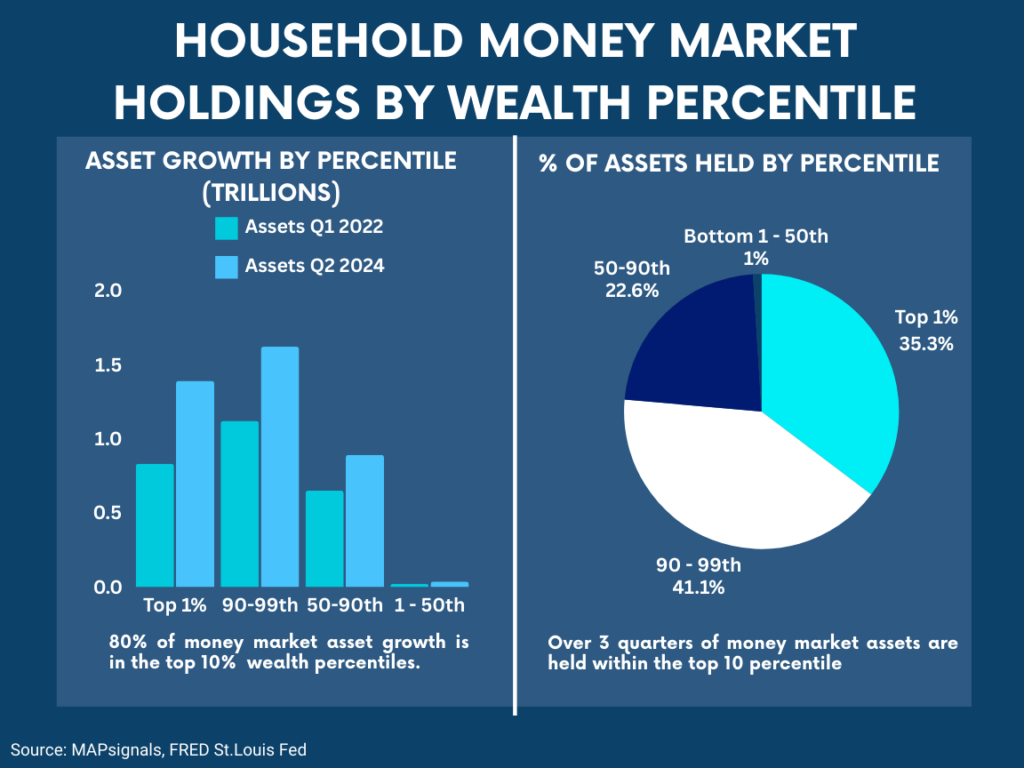

This week I took the liberty to break down the massive money market bubble by wealth percentiles. Specifically, I wanted to learn which strata of earners were mostly responsible for the big capital influx into MMs.

For this exercise, I bucketed money market assets into 4 wealth groups:

- Top 1% wealth percentile

- The 90-99th percentile

- The upper middle 50-90th percentile

- And finally, the bottom 50th percentile

Each of these wealth groups vary based on the state you reside in. But a good idea for a 1% earner is those making well north of $500k per year.

The top 10% bucket are typically the 6-figure crowd.

It should be no surprise that wealthy investors are responsible for the lions’ share of money market asset growth.

Check this out. As of Q2 2024, the top 1% of households controlled 35.3% of MM assets. The 2nd tier, 90-99th percentile made up just over 41% of the total pie.

For those keeping score, that’s 76% of household MM assets. But what is striking is the growth of cash assets from each cohort.

The top 10% of households were responsible for 80% of the money market asset growth as just over $1 Trillion.

This is the wealth transfer that’s building up a lot of potential energy soon to be put to work elsewhere.

When one asset class thrives, another suffers.

Notice that beginning January 2022 through June 2024, popular income-equities massively underperformed, indicating dividend stocks were funding the explosion in money markets.

From 2022 – June 2024, the S&P gained 18.79%. Under the surface saw incredible underperformance from dividend sectors:

- Real Estate stocks (XLRE ETF) fell 19.22%

- Utilities (XLU ETF) barely eked out a gain of 3.26%

- Consumer Staples (XLP ETF) flatline with a 5.3% gain

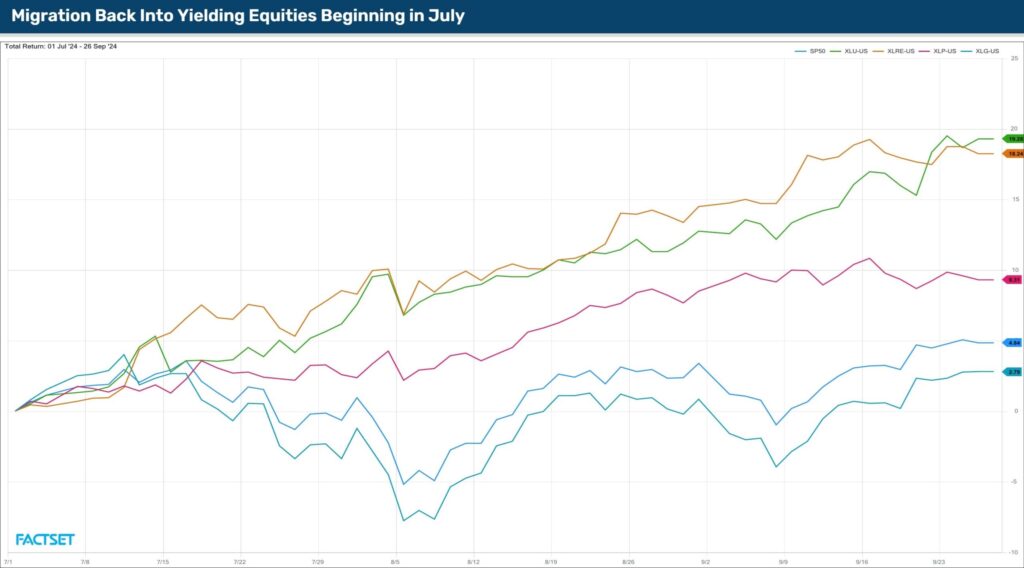

Back in June, we were early in suggesting a monster reversion trade was coming. After the June CPI cemented the case for the Fed to finally start cutting rates, a violent money wave was set in motion.

Small-caps rips. Breadth improved.

But also hidden under the surface was a monumental money-shift into dividend-oriented equities.

Using the same framework as above let’s look at the sector performances since July. That’s when the money migration was set in motion.

From July 1st – September 25th:

- High-yielding Utilities have gained 19.2%

- Real Estate isn’t far behind jumping 18.2%

- Staples ripped 9.3%

- The S&P 500 barely budged eking out a gain of 2.7%

Without question, money market assets are searching for a new home as rates fall. Odds are now calling for Fed Funds rates to reach a 3-handle in a year+.

Now I’m imagining FAs making this call to their clients.

Hey Mrs. Debbie, it’s time to jump off the money market horse and look at dividends as an alternative.

And my recent FA channel checks suggest this is the case. Of course, there are other income alternatives to mention like munis and corporates…those do have a place for specific investors.

But last I checked, Warren Buffett didn’t get rich off munis!

Seriously though, the biggest prize resides in owning all-star companies that have wonderful businesses, high profit-margins, and consistent dividend growth.

That’s the holy grail of investing as far as I’m concerned. Don’t focus on the highest yielding stocks…those yields won’t keep up.

Instead focus on compounders. That’s the ticket.

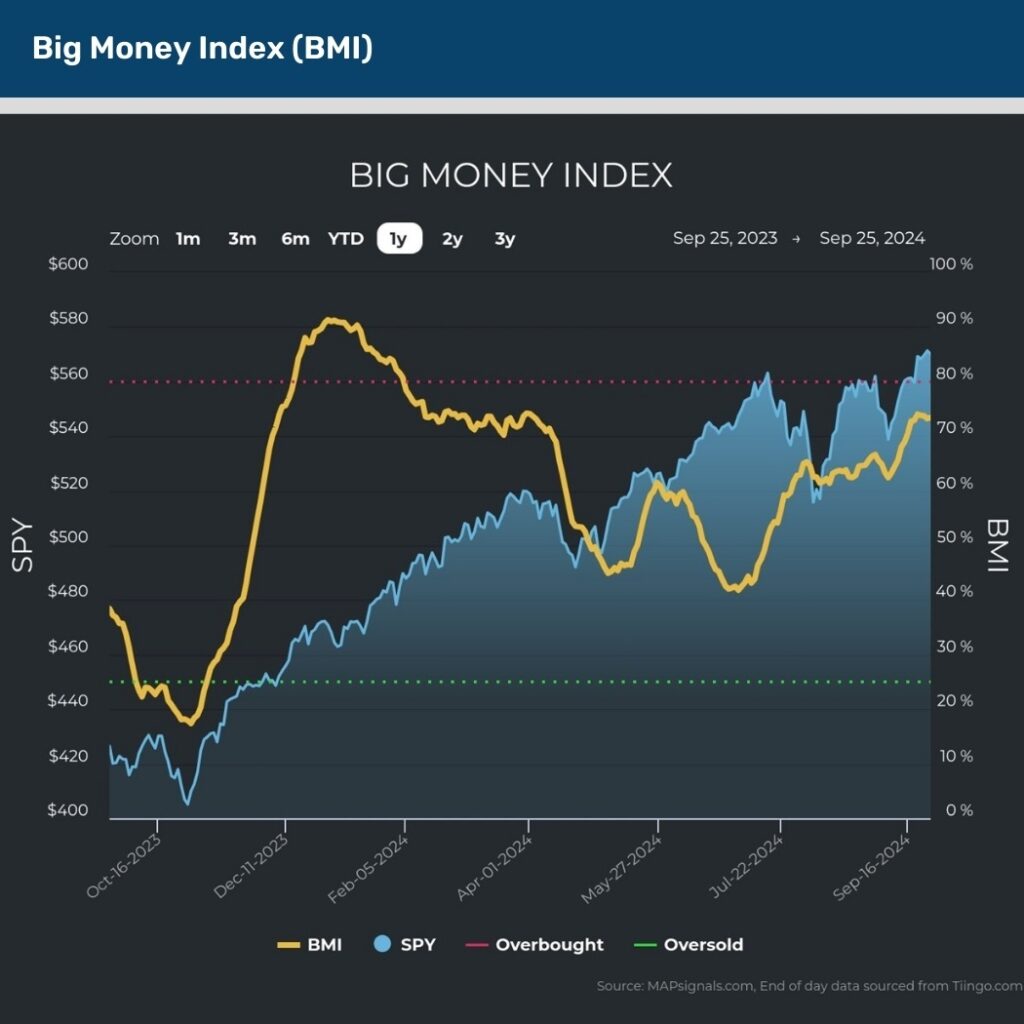

And the other evidence that this money wheel is rolling is by looking at the Big Money Index (BMI). It’s ramping as plenty of high-quality income stocks are benefiting from the trillion-dollar money wave:

Calls are happening all over the country right now. Cash is no longer king.

Hopefully you see the call in front of you today.

There’s a cash bubble. Those assets are searching for a new home. Elite dividend growth stocks are prime beneficiaries in 2025.

That’s why we released an all-star 32 stock report focused exclusively on this theme. MAP PRO subscribers can find it here.

Don’t wait for the media to blow the bullhorn on dividend stocks…you’ll miss the boat.

Just follow the money…and it’s already in motion.

Here’s the bottom line: Wealthy investors have a looming choice. The trillion-dollar money market bubble is set to unwind.

Dividend stocks were abandoned as the thirst for yield gathered steam.

The evidence highlights how this crowded trade is reversing course. Dividend areas are rerating by the week.

2025 is setting up to be a monumental year for high quality superstar dividend growth stocks.

The call to consider other income alternatives is in motion. Now’s a wonderful time to take advantage of one of the biggest themes we are witnessing.

Author: Lucas Downey