2024 October Surprise Playbook – October 3, 2024

October brings falling leaves, pumpkins, and spooky Halloween.

It’s a season of change.

The same goes for election years in the stock market.

Here’s your 2024 October surprise playbook.

The term October surprise dates back to the 19th century as presidential elections routinely experienced unexpected events heading into November.

Recent notable October surprises include:

- 1968 Humphrey’s Halloween Peace

- 1972 Kissinger’s Peace is at hand press conference

- 1980 Reagan’s American hostages held in Iran

- 2000 Bush’s drunk driving report

- 2008 record rise in unemployment

- 2012 Hurricane Sandy

- 2016 email scandal

- 2020 COVID White House outbreak

Could there be an October surprise in 2024? My vote is yes.

Whether or not October surprises influence elections is up for debate. What isn’t, though, are the powerful patterns that exist in stocks in the 10th month of the year.

Today we’ll revisit a powerful election study we showcased months ago highlighting the spooky returns typical of October.

We’ll take it a step further, unmasking how you can play this setup to your advantage.

Don’t get scared if 2024 brings an October surprise.

Get prepared!

2024 October Surprise Playbook

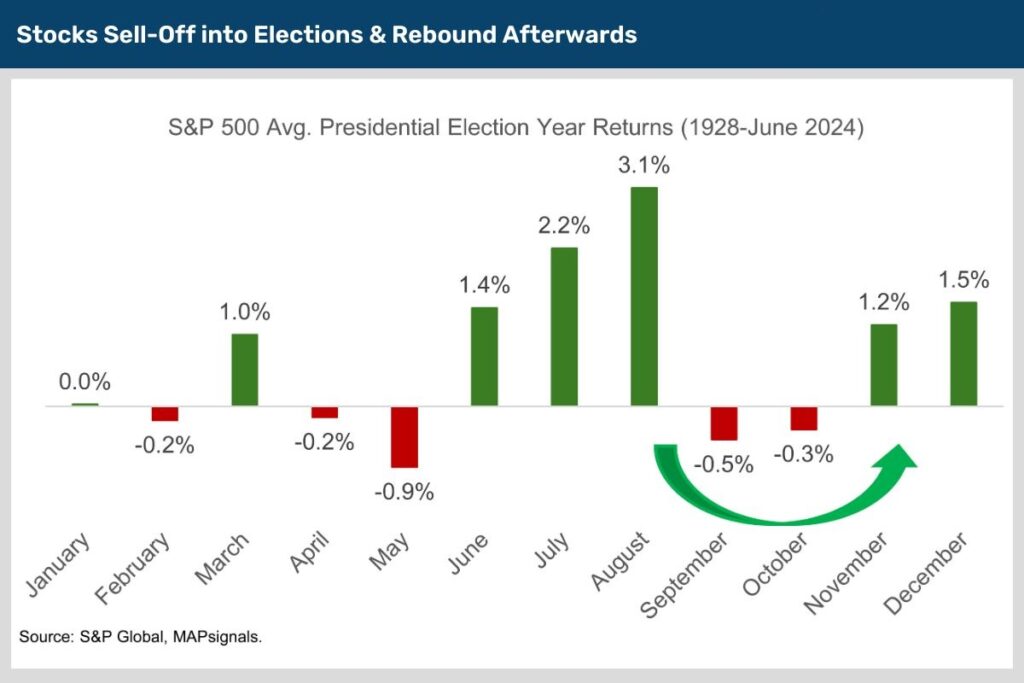

In our ultimate election year playbook, history revealed how stocks tend to sputter in September and October heading into the vote.

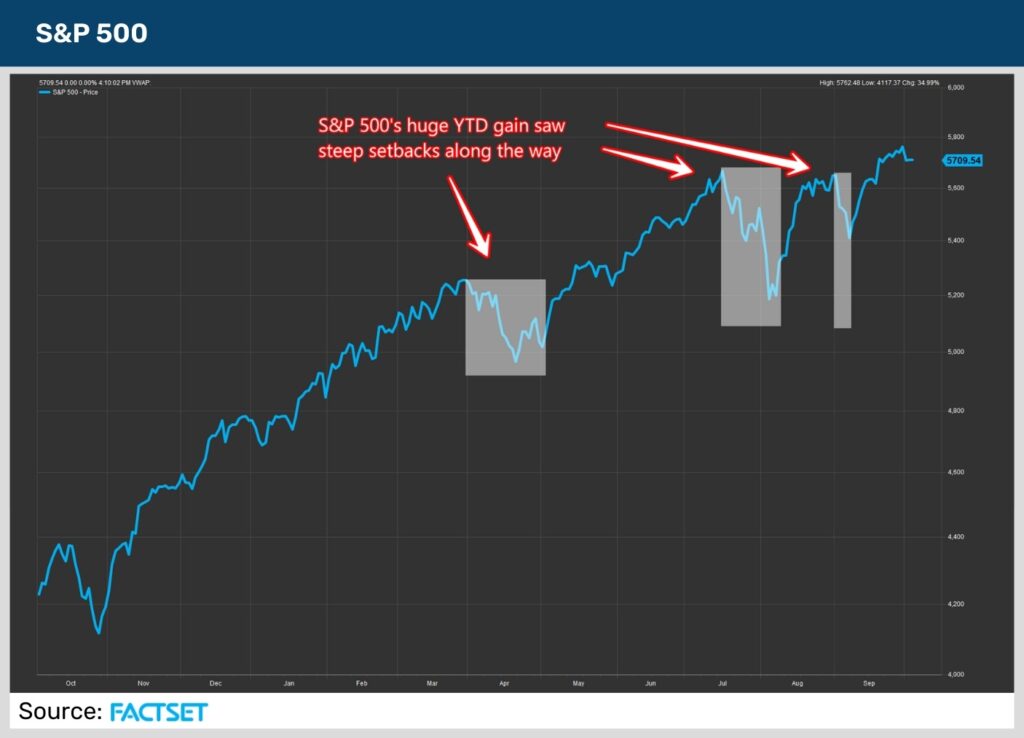

While September closed up 2%, the best since 2013, don’t forget about the big 4% drop to begin the month. 2024 has seen massive performance of +20.8% with 3 notable setbacks along the way:

Now that October is here, don’t expect smooth sailing. Since 1928, election year Octobers see the S&P 500 drop .3%.

While there is no guarantee what the future holds, don’t be surprised if October brings equity weakness:

We’ve been on record voicing how you’ll want to buy any pre-election dips. When you slice up October election year performance, a powerful pattern emerges.

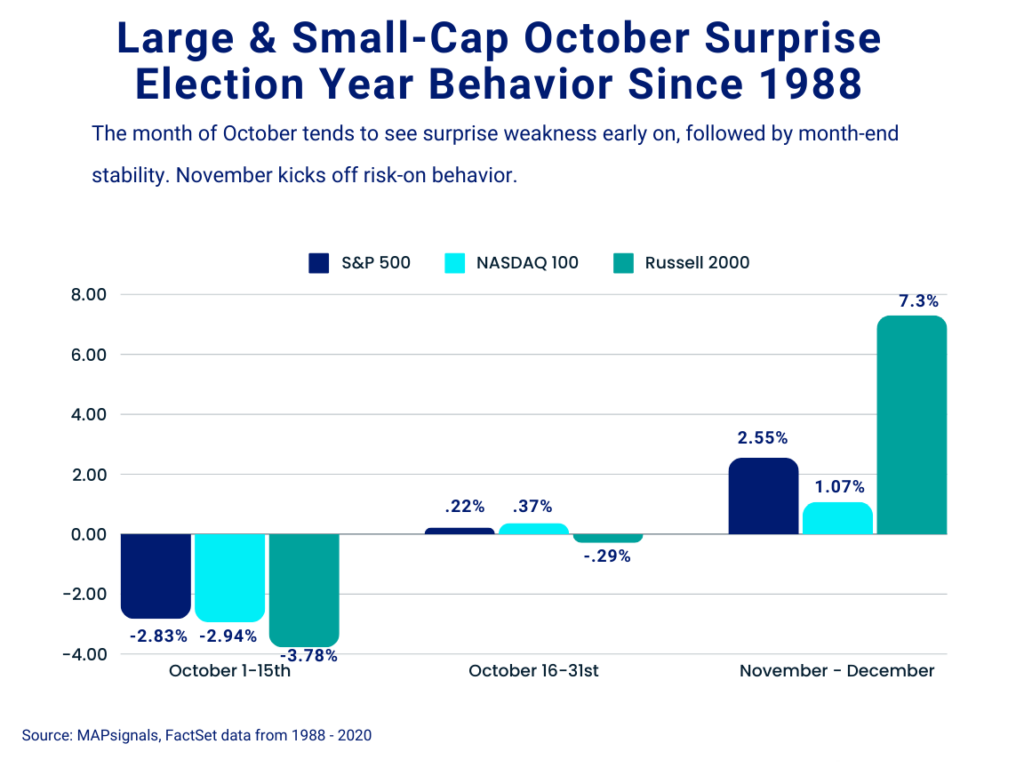

Turns out, the brunt of October weakness hits in the first half from October 1st through 15th. Check this out.

Analyzing election year Octobers since 1988, the first half sees the S&P 500 drag 2.83% before firming up in the back half.

Additionally, this anomaly can be seen in both the tech-heavy NASDAQ 100 as well as the small-cap Russell 2000.

Importantly, bumpy Octobers pave the way to jumpy Novembers and Decembers:

Hopefully your eyes are zeroing in on the powerful setup. October dips tee up big rips…especially for small-cap stocks.

The average 7.3% surge in the Russell 2000 in November and December of election years only reinforces our overweight stance in smaller capitalized firms into next year.

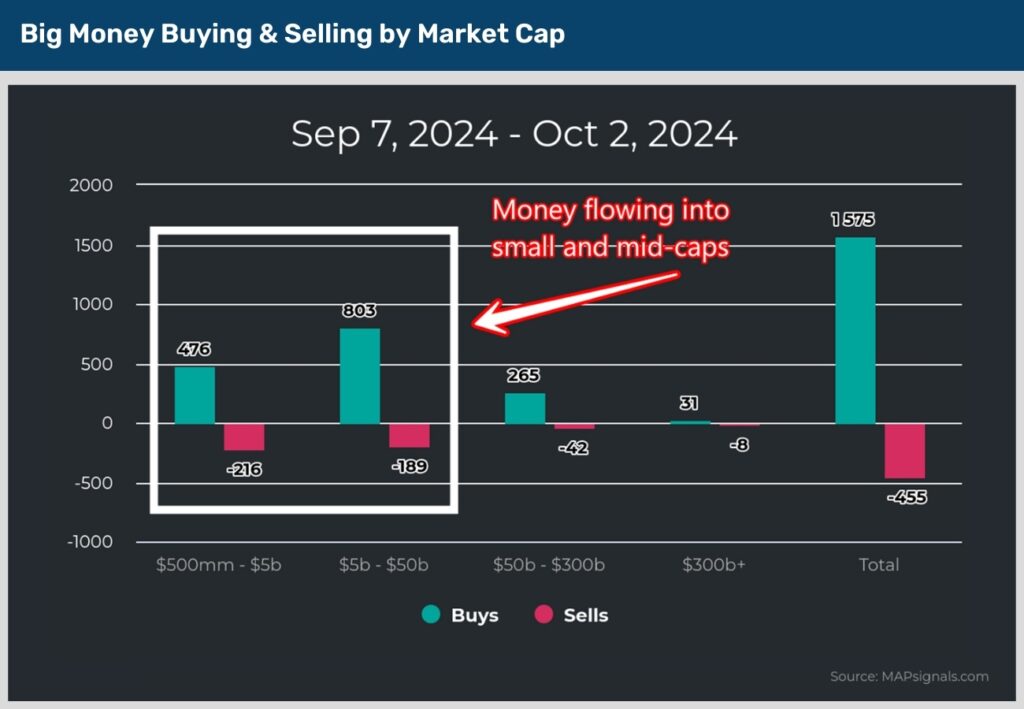

And our unique Big Money lens agrees. Our Big Money Index (BMI) continues to break higher week after week, highlighting institutional sponsorship of small- and mid-caps…

The past 4 weeks of money flows shows heavy appetite for smaller cap companies with 81% of buys targeting market caps below $50 billion:

And to be clear, off-the-run small- and mid-cap stocks have been beaming all year in our data. When you dive below the surface, we find all sorts of single stock stories working.

One example is Allison Transmission Holdings (ALSN). With a rock-solid Score of 79.3, indicating healthy institutional support alongside favorable forward earnings growth, that’s the go signal.

Below showcases how ALSN has made our rare Top 20 list 6 times this year. Typically, we find recurring inflows power stocks higher and higher.

That’s the stairway to heaven that all great equities exhibit:

For me, the playbook is simple.

Election mudslinging is well underway. Expect an October surprise to jitter markets.

But don’t get spooked out of stocks. Instead, strap on the helmet and buy any pre-election dip that typically emerges in the first half of October.

Focus on off-the-run stocks that the media doesn’t cover. That’s where institutional investors find alpha.

Beginning in November, the bearish costumes often fall to the wayside and markets begin a swift recovery.

Don’t follow the headlines…follow the money.

Here’s the bottom line: October surprises date back to the 1800s. Heading into presidential elections, unexpected events routinely surface out of the blue.

Just don’t let these surprises spook you out of stocks.

History shows that early October weakness is met with back-end October stabilization. Furthermore, November kicks off bullish season for equities.

If you’re like me and want to kick start your portfolio during this spooky period for markets, get hedge fund quality research.

Not only will you learn what truly moves markets and stocks… money flows…

You’ll also find under-the-radar stocks loved by institutions.

That’s the October surprise your portfolio will thank you for!

Lastly, join me at the Wealth365 2024 Election Summit, Tuesday, October 15th at 10 a.m. ET, as I present: How to Spot Monster Small & Mid-Cap Opportunities this Election Season.

You won’t want to miss it.