2025 is Set to Be a Stock Picker’s Market – December 5, 2024

When all hope is lost, we yell to buy stocks.

When all hope is found, we enjoy the ride.

2025 is set to be a stock picker’s market.

One of my all-time favorite investor quotes came from The Oracle of Omaha, Warren Buffett.

Beware the investment activity that produces applause; the great moves are usually greeted by yawns.

This is so true. How often have we witnessed sentiment shift to extremes…only to revert to the mean?

A terrific example was one of my favorite calls from this Summer, when we made an extremely non-consensus pitch to get ready for a monster reversion trade for the ages.

Back then, the crowd could only imagine a world where the MAG 7 would surely dominate…forever. Suggesting the other 493 names were ready for liftoff was akin to blasphemy.

This easily disguised opportunity teed up one of the most powerful mean reverting trades seen in years.

In layman’s terms, underperforming stocks soared, and many prior leading equities took a backseat.

Today we’ll discuss the eye-popping spreads at the individual stock level.

Wall Street’s trade of the year is still very much in full force.

2025 is Set to Be a Stock Picker’s Market

Pay attention to extreme sentiment. Rarely does it last.

Back in June my colleague, Alec Young, suggested in timely fashion that it was the best time in history to be a stock picker.

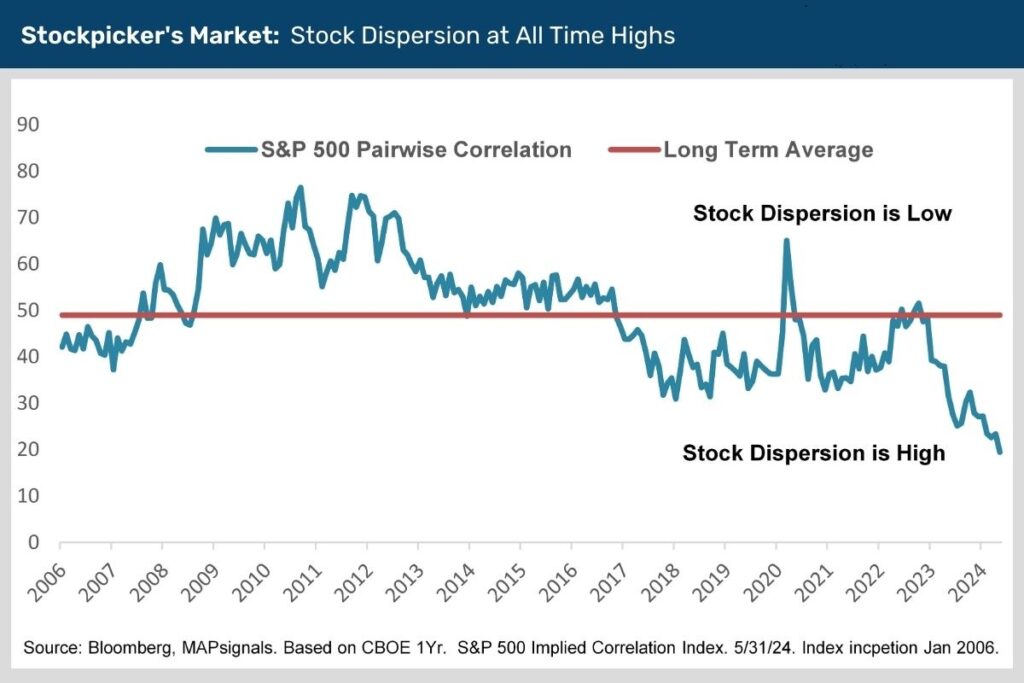

He highlighted one of the best charts you could have encountered 6-months ago. Stock dispersion was at all-time highs.

Said differently, correlation fell apart.

The term correlation in finance is all related to how one stock behaves relative to another. When equities move in tandem, correlation is said to be high.

When one similar stock zigs and the other zags, correlation breaks down.

Pairwise correlation analyzes this behavior, measuring performance dispersion in the stock market.

In late May, this barometer fell to 19%, well below the historical average of 49%:

The beauty here is we have a snapshot in time to review the spread between the S&P 500’s winners and losers.

Below, shows the YTD performance through May 31st of the top and bottom performing stock by sector.

In technology, the biggest winning name was Super Micro Computer (SMCI) which was up 176% compared to -40% return for EPAM Systems (EPAM).

In Health Care, Moderna (MRNA) was +49.2% while Illumina (ILMN) sank -24% (disclosure I own ILMN).

These are spreads so wide you can drive a truck through them:

Now, we didn’t know how abrupt the swing back would be at the time. But Wall Street’s trade of the year kicked off shortly after.

Not only did the June CPI report on July 11th pave the way for the Fed to begin cutting rates in September…but there was a growing belief that a new Presidential administration could be on the way.

These forces ignited a few mammoth shifts to begin on July 11th 2024. This is the date where everything changed.

Small-caps sprang to life.

Mid-caps roared.

Mega-cap tech no longer led the way.

If we do a similar snapshot of the S&P 500’s best and worst performing stocks since July 10th, notice how epic the reshuffle has been.

Super Micro Computer is the worst performing stock, falling 53.5%. Palantir is the best performing name, jumping 145.8%.

In the Industrial group, Axon Enterprise (AXON) ripped 145% and Huntington Ingalls Industries (HII) fell over 20%:

These are seismic moves. And we believe we are in the early innings of this revival.

It highlights the need for powerful research tools to get an early alert when these rare setups begin.

Fortunately for MAPsignals, we have a radar screen that spots UFSs (unusual flying stocks) loved by the Big Money!

To grab 2 all-stars from the above graphic, here’s Axon appearing out of nowhere on our Top 20 report on August 13th. That’s an 86% move for those keeping score:

Next, here’s Royal Caribbean (RCL) with a dozen yawning inflow signals. Few stocks on earth have had this level of institutional sponsorship:

To me, the biggest wins aren’t coming from those applauding the rally today…it’s those who, like me, were willing to get in shape while the crowd was uninterested.

That’s where the Big Money is made.

This is where having an evidence-based approach is so powerful.

Which brings us to my final closing thoughts.

There are going to be great moves to make in 2025.

Author: Lucas Downey