This Oversold Signal is Undefeated – November 21, 2024

Every now and then, a stat jumps off the screen.

While major indices climb to new highs, certain areas are being liquidated.

One group in particular triggered extreme outflows. The great news is this oversold signal is undefeated.

Consider this. Going back thousands of years, humans have gazed at the sky in search of answers.

According to one study by Northern Arizona University, it’s estimated that astronomical observations go back as far as 30,000 years ago.

Cavemen colored walls. Early humans assorted rocks to plot the movement of stars. Even the calendar that we know today is traced back to windows of twinkling light in the black of night.

Stargazing offered information.

Humans have always searched for meaning in patterns.

As it relates to the stock market, patterns can be seen and measured. Money flows reveal a beautiful continuous cycle.

Last week, our unique Big Money lens spotted heavy investor selling in one particular sector…and if history is a guide, it’s teeing up one mammoth upside setup.

And the best part is this – few are aware of it.

Healthcare Stocks See Largest Outflow Since Early 2023

Our stance has been bullish all year. And we believe the Trump 2.0 rally is only just starting.

However, not all stocks were invited to the party recently. Plenty of investors are concerned about how the Trump administration will treat vaccine makers and hospital operators.

These fears reached a pinnacle on November 15th when 70 discrete companies logged outflow signals according to our research.

Below, you’ll see how rare this level of selling is. Over the past 4 years, just a handful of days saw similar patterns:

To the untrained eye, healthcare stocks may appear as a no touch. But respectfully, we disagree.

That’s not because we have a gut feeling that healthier days lay ahead. It’s simply due to the fact that we can measure this rare datapoint.

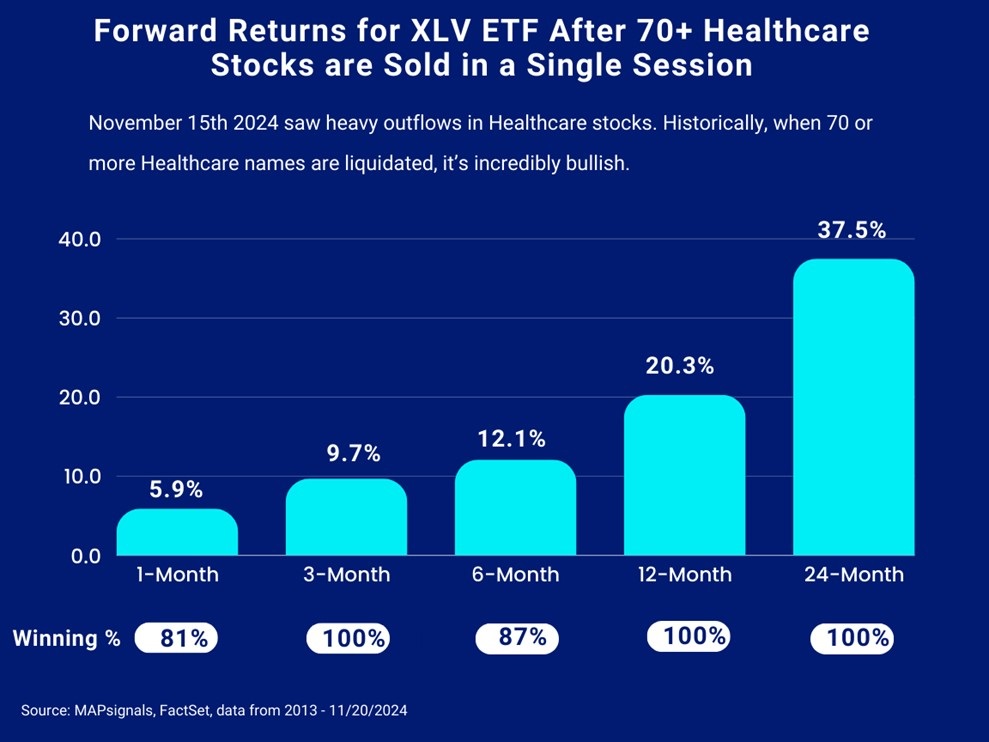

This Oversold Signal is Undefeated

When we go back to 2013, there’ve been 16 prior instances when 70 or more healthcare stocks were dumped.

In fact, these oversold moments ignite ferocious rallies.

Check this out. Whenever we’ve seen 70 or more Healthcare equities sold in a day, here’s what happens next for the Health Care Select Sector SPDR Fund (XLV ETF):

- 3-months later XLV jumps 9.7% on average

- 6-months later XLV lifts 12.1%

- 12-months after, XLV rips 20.3%

- 24-months later, XLV catapults 37.5%

For those keeping score, XLV has never been lower 12 and 24 months after a seismic quake like this. I’ll say it again, this oversold signal is undefeated!

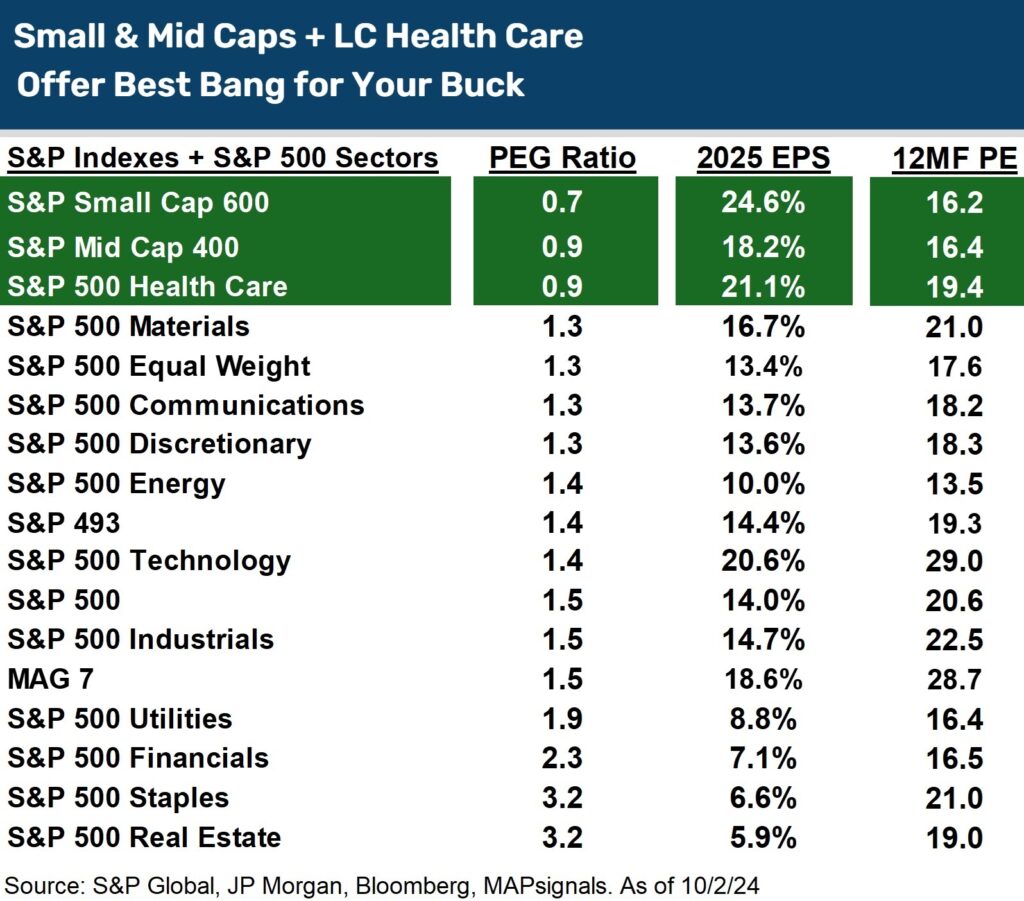

Now, for those skeptical of money flow patterns, I’ll clue you in on another feather in the cap for health care stocks.

They offer the best bang for your buck. Last month, we discussed how to buy low at all-time highs.

It turns out the S&P 500 Health Care sector sports a low .9 PE/G ratio, rivaling our favorite overweight areas, small and mid-cap stocks:

Our strategy is all about spotting what others miss. We spent many years on Wall Street trading desks handling massive equity orders for some of the biggest funds on earth.

We built our data-driven process on that unique experience.

While most Health Care names get punished, there are still winners…big winners.

Each day our portal updates with the 20 highest ranking stocks by major sector group. Here’s a screengrab of this morning’s top ranked names with their performance since being first profiled on the report.

I’ve blurred out the ticker information as this is for MAP PRO members. But as you can see, we’re able to spot and find the outliers the Big Money is betting on:

What this means for you is simple: consider grabbing health care names, as we believe this level of extreme selling won’t last forever.

Maybe grab XLV if it makes sense for your situation.

But if you’re like me, there’s a bigger opportunity…much bigger.

Small under-the-radar drug names are under heavy accumulation, and their tickers are not on the lips of the mainstream media.

There’s a world of market-beating opportunities out there…you just need a map to see it!

Here’s the bottom line: Patterns reveal extremes. We can measure them and get a data-driven return profile.

Health Care stocks are witnessing the largest sell flows in well over a year. There’s evidence that this window of opportunity won’t last forever.

Author: Lucas Downey