Capitulation is Here, Now Go Buy Stocks – August 8, 2024

Investors are running scared.

Markets are plummeting as volatility surges.

Here are 7 important words to heed: Capitulation is here, now go buy stocks.

Turn on any financial news network and you’ll find plenty of reasons to take your portfolio to the sidelines:

- Interest rates are plummeting as recession fears swirl

- Unwinding carry trades send currencies gyrating

- Stocks are crashing

- Volatility markets are exploding

The list goes on and on. And while these concerns are real, making the decision to “sit this one out” will likely prove to be costly.

That’s because extreme capitulation is an investor’s friend. When investors panic, history proves that you want to be greedy.

Today, we’ll dive into the 3 most important charts of the latest stock market swoon.

The evidence suggests a violent risk-on rally is coming soon.

Capitulation is Here, Now Go Buy Stocks

To kick things off, let’s begin with the carnage in equities.

Stocks have finally approached correction territory. The S&P 500 fell from a high of 5667 to an intraday low of 5119 on Monday.

That puts the peak to trough pullback at 9.7%.

Few could have imagined that was possible just a few short weeks ago:

But what makes this pullback unique and significant comes down to money flows. Monday’s puke saw extreme capitulation.

Our data revealed that 374 discrete equities were sold. To put that into perspective, that’s the most selling since March 2023 during the regional banking crisis.

Below notes Monday’s collapse and prior similar episodes over the last few years:

There should be a couple of things your eyeballs notice about this graphic:

- First, rarely does this level of red stick around for long

- Second, markets often see a relief rally soon after

Here’s the hidden truth behind Monday’s brutal plunge. This level of selling is extreme and bullish for stocks going forward.

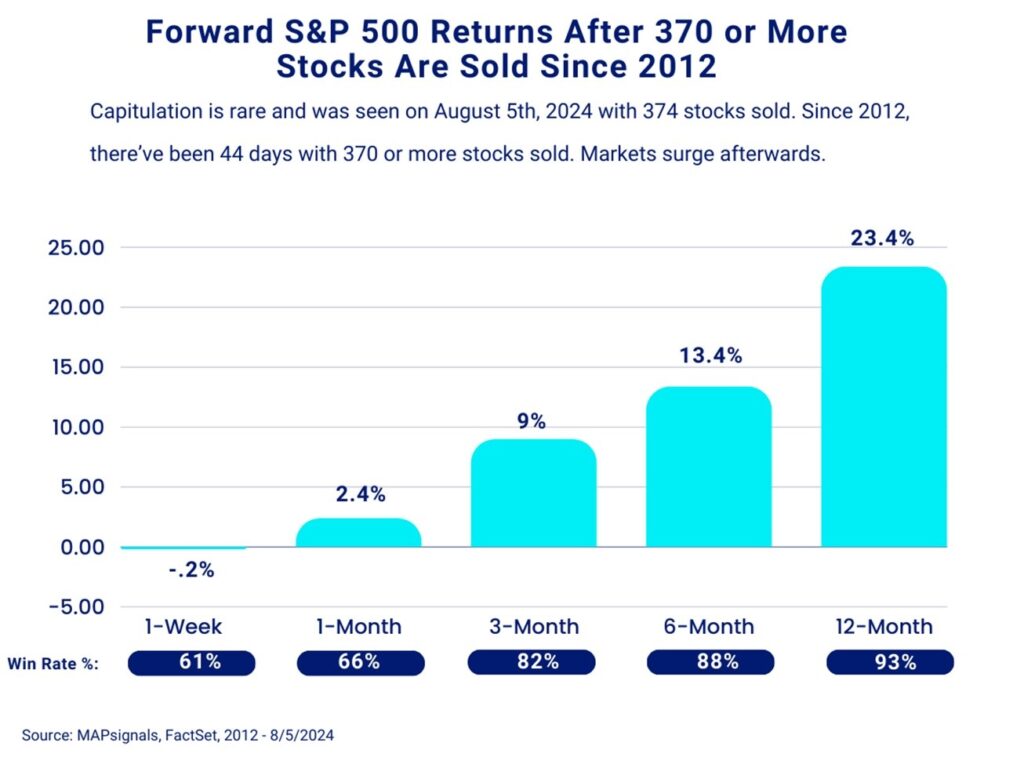

Since 2012, there’ve been a total of 44 days where 370 stocks were sold. Here’s how the S&P 500 fares after these panics:

- 3-months later, the S&P 500 rips 9%

- 6-months later, stocks pop 13.4%

- 12-months later, equities rocket an average of 23.4%

Let’s all say it together. Capitulation is here, now go buy stocks!

This data alone should have you jumping for joy. But if you’re still not convinced, I’ve got two more bullish bullets loaded in the holster.

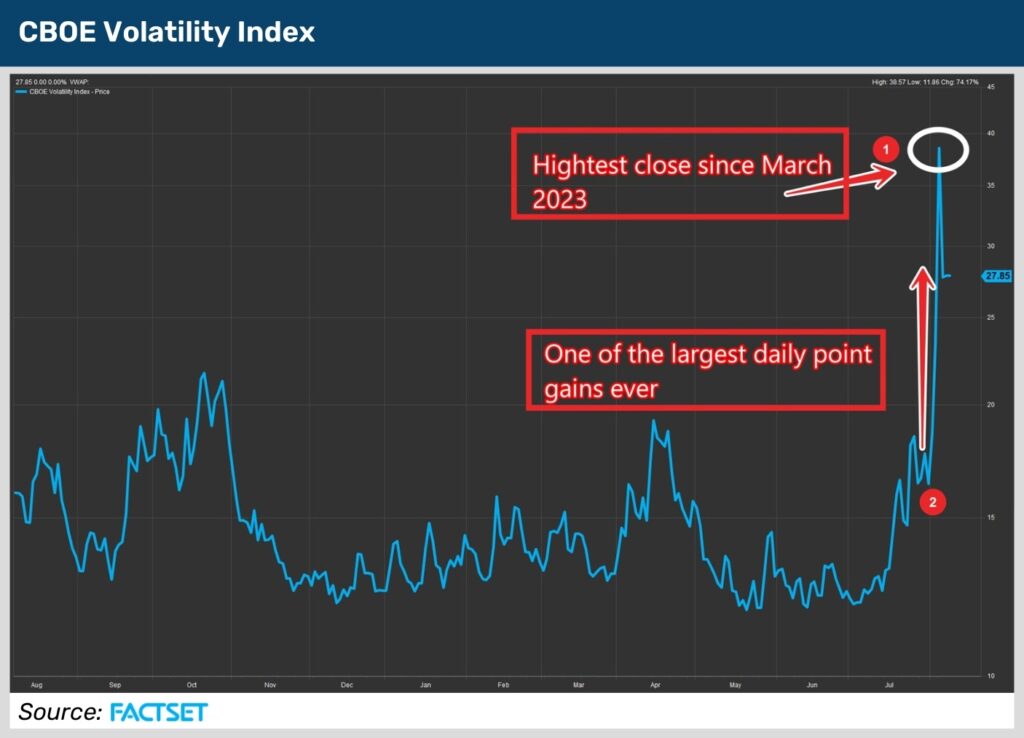

And these come down to what’s occurring in volatility markets. The CBOE Volatility Index (VIX) measures the premiums for near-term options on the S&P 500.

When the VIX explodes, traders are scrambling to protect and hedge portfolios.

On Monday, the VIX reached a high of 65 in pre-market trading…a breathtaking level. It closed at 38.57, the highest level since March 2023.

Not only that, something also occurred that’s even rarer. The VIX closed up 15.18 points, one of the steepest daily rises ever.

I’ve outlined these 2 datapoints below:

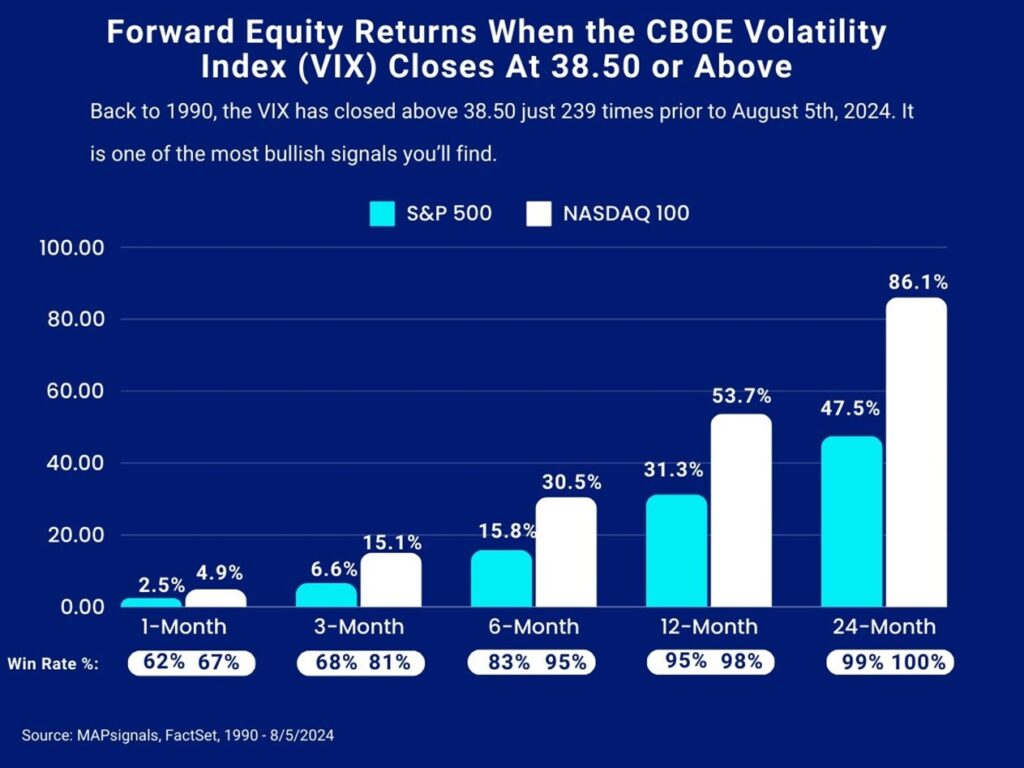

Here’s why VIX readings of this magnitude matter. If you go back to 1990, a VIX measuring 38.50 or greater has happened 239 times.

Here’s how the S&P 500 and NASDAQ 100 perform with a VIX closing at 38.50 or higher:

- 6-months later the S&P 500 climbs 15.8% and the NASDAQ jumps 30.5%

- 12-months later, the S&P rips 31.3% and the NASDAQ surges 53.7%

- 24-months after, the S&P 500 catapults 47.5% and the tech-heavy NASDAQ rockets 86.1%

Ladies and gentlemen, let me say it once more. Capitulation is here, now go buy stocks!

We aren’t going to let the bears off the hook just yet. There’s one other datapoint to discuss.

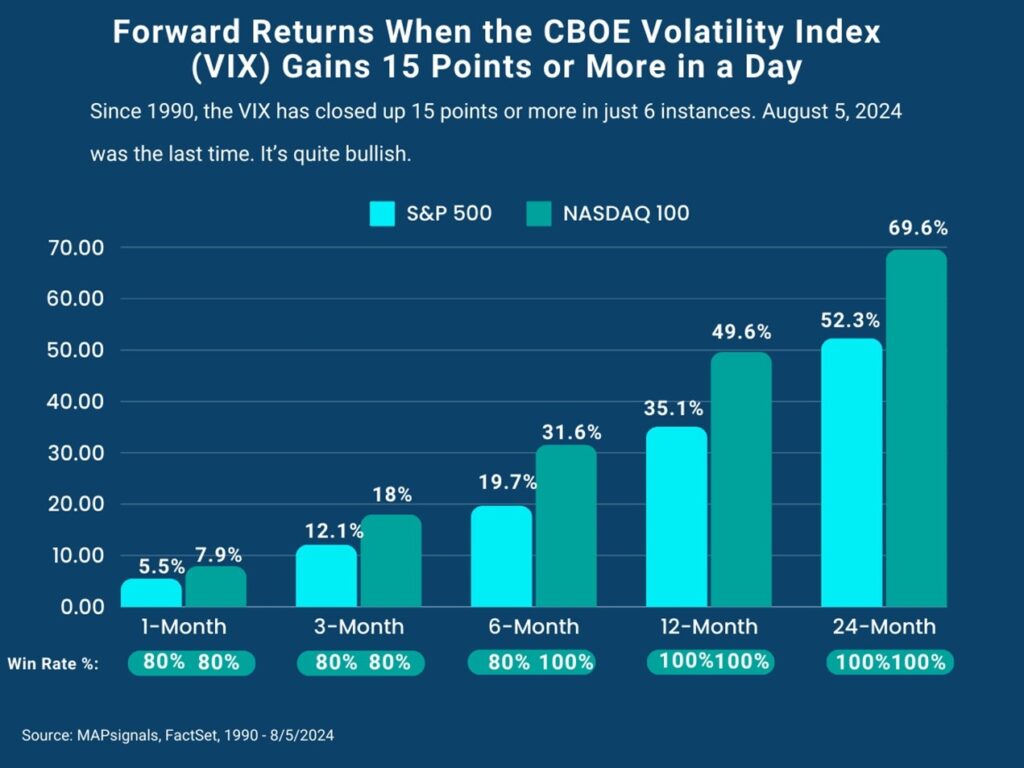

Turns out the 15-point VIX climb is significant. In fact, a VIX jump of 15 points or greater has happened just 5 times prior to August 5th.

One of those moments occurred in 2008. Two came during the March 2020 COVID pandemic crash.

Here’s why you’ll want to hug a bear.

Since 1990, whenever the VIX pops 15 points or more, stocks absolutely scream higher with:

- 3-month average gains of 12.1% for the S&P 500 and 18% gains for the NASDAQ 100

- 12-month gains of 35.1% for the S&P 500 and 49.6% gains for the NASDAQ 100

- Be bold for 24-months and you’re staring at 52.3% gains for the S&P 500 and 69.6% gains for the NASDAQ 100

If I were you, I’d print this image out and stick it on your refrigerator…

For good measure I’ll say it one last time. Capitulation is here, now go buy stocks.

Rarely do we see capitulation of this magnitude. Highly levered money managers are being forced to cut risk…and that’s teeing up a wonderful setup to buy high-quality stocks on sale.

Once the selling stops, you can bet that smart Big Money investors will flock to companies with huge earnings growth and multi-year tailwinds.

This is why early on Monday, we were telling our members to be greedy and listing 3 stocks to own as this pullback plays out.

Don’t make the common mistake of sitting idly by…once selling stops, stocks will pop to the amazement of the crowd.

It’s supply and demand 101.

Let’s wrap up.

Here’s the bottom line: There’s every reason in the world to be fearful. But historical evidence suggests going against the crowd in a big way right now.

Capitulation offers a small window of opportunity to get an all-star stock list together and piece into the best businesses at fire-sale prices.

Anytime 370 stocks or more are sold in a day, markets rocket afterwards.

Couple that with a VIX above 38.50 and an uber-rare 15-point upside thrust, and you’re looking at the equivalent of holding stock market aces.

Being fearful will cost you big time right now.

Now’s the time to put some chips on the table.

Don’t wait for the media bull-whistle to blow…by then it’ll be too late, and stocks will be well off their lows.

Author: Lucas Downey